Manage your loans and debts easily.

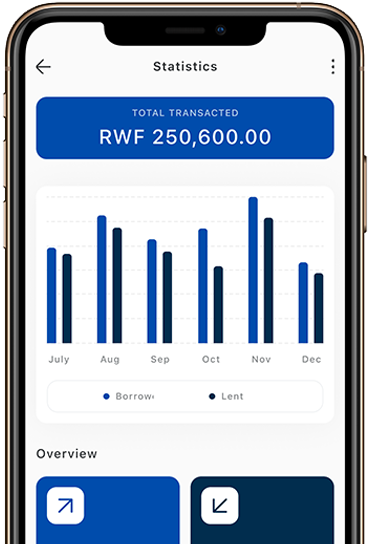

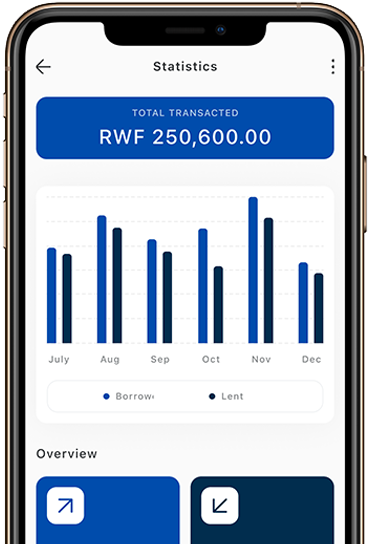

CrediTrack helps you keep track of loans, repayments, and outstanding debts in real-time. Stay on top of your finances with ease.

Assess the trustworthiness of your borrowers using CrediTrack’s borrower reputation system. Make informed decisions before lending money.

If a borrower defaults, CrediTrack helps you connect with debt recovery agents, ensuring smooth debt recovery processes.

Monitor every loan transaction, repayment status, and outstanding balance with CrediTrack’s real-time updates.

Evaluate the creditworthiness of your borrowers using CrediTrack’s reputation scoring system to make informed lending decisions.

If a borrower defaults, CrediTrack connects you with trusted debt recovery agents to handle the situation professionally.

Build detailed borrower profiles to help track credit history and make decisions based on reliable data.

CrediTrack provides real-time loan and repayment tracking, so you can easily monitor the status of your loans, track repayments, and keep tabs on outstanding debts all in one place.

CrediTrack offers a subscription-based model with different pricing tiers depending on your needs. Please visit our pricing page for more detailed information about the available plans.

CrediTrack features a borrower reputation system that allows you to assess the trustworthiness of borrowers based on their past behavior, repayment history, and other factors.

If a borrower defaults on a loan, CrediTrack connects you with professional debt recovery agents who can assist you in recovering the outstanding amount quickly and efficiently.

CrediTrack uses industry-standard encryption and security protocols to protect your data. All information, including loan details and payment history, is kept safe and confidential.

CrediTrack provides unlimited cloud storage for all your communications, ensuring that your messages, loan details, and repayment records are securely stored and easily accessible at any time.

Verify borrowers with ease to ensure trust and minimize risk. CrediTrack provides insights on borrower reliability, giving you peace of mind.

Effortlessly track all lending and repayment records in one place. Stay organized with automated records and reminders for outstanding loans.

Get support from trusted debt recovery agents in case of unpaid loans, helping you secure repayments without the hassle.

All lending records are securely stored and encrypted, ensuring that your financial data remains private and protected.

“CrediTrack has helped me manage my loans effectively. I can now keep track of my repayments and avoid any late fees. It’s truly a game-changer for me.”

“I used to struggle with trusting people I lend money to, but with CrediTrack's borrower verification feature, I feel much more secure.”

“Thanks to CrediTrack, I was able to recover money I lent to a friend. The debt recovery feature made the process simple and effective.”

“CrediTrack has completely transformed the way I manage my loans. I can easily track multiple loans and ensure I never miss a payment.”

CrediTrack’s innovative features allow lenders to verify borrowers, ensuring peace of mind when lending money in Rwanda.

CrediTrack introduces a new feature that helps recover unpaid loans quickly and effectively, ensuring financial security.

Trust is key when lending money. Discover how CrediTrack’s borrower verification ensures your loans are safe in Rwanda.